Ethiopia

High Potential, High Impact, Early Stage

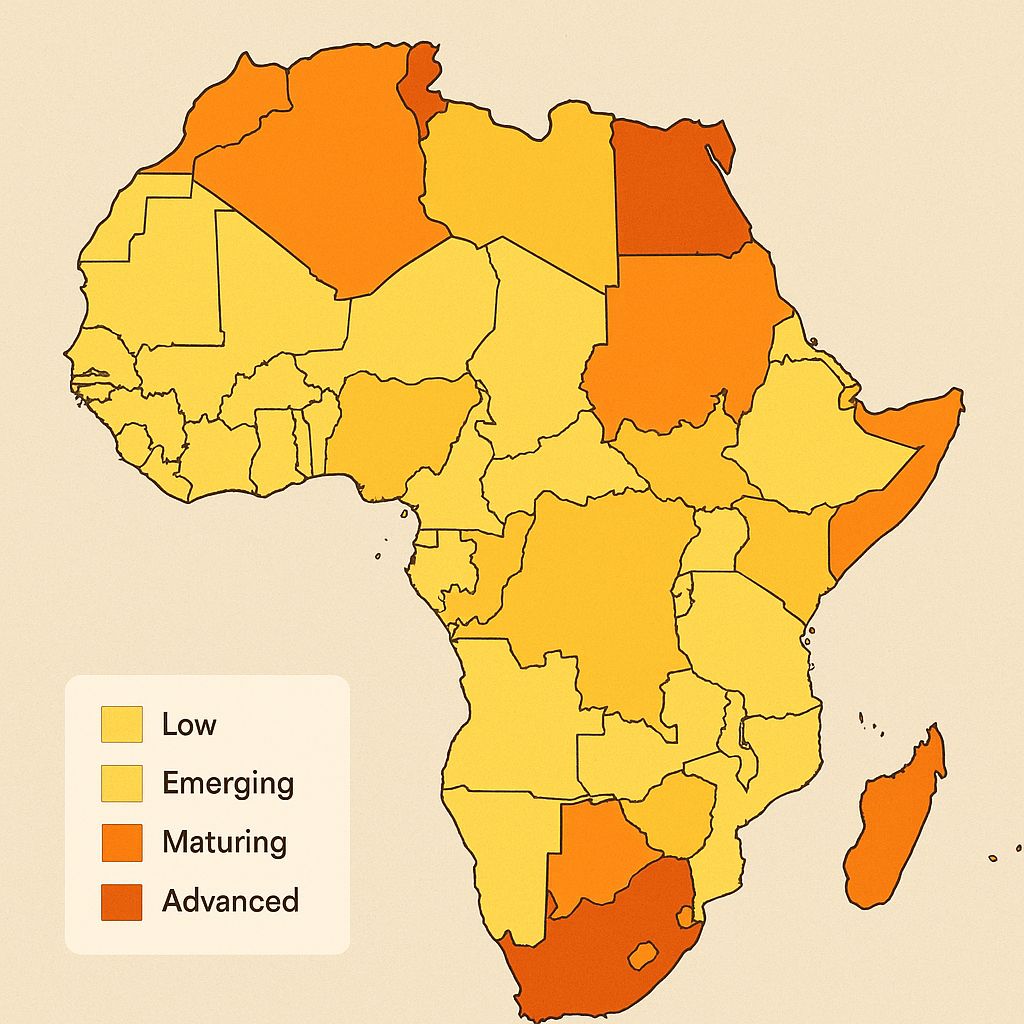

Solar Index Overall

Ethiopia is a solar giant in the making. With exceptional solar irradiance and urgent rural electrification needs, the country offers a powerful case for off-grid and impact-driven solar development. However, regulatory and financing bottlenecks present challenges for scalability.

Kenyan Solar Market

Key Insights

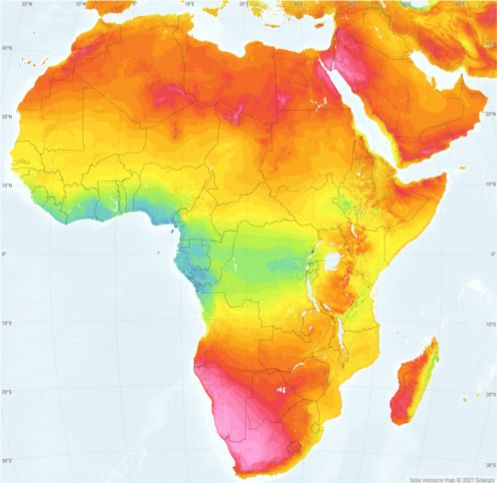

Solar Potential

With daily solar irradiation often exceeding 5.5–6.0 kWh/m², especially in the eastern and northern highlands, Ethiopia ranks among Africa’s best in raw solar resource potential. This provides a strong technical basis for both mini-grid and solar farm deployment.

Regulatory Clarity

While Ethiopia has set clear targets for universal electrification and released renewable energy tenders, the policy and licensing environment remains fragmented and bureaucratic. Investors must prepare for long lead times and evolving frameworks.

Financing Access

Commercial solar financing is underdeveloped. The majority of capital still flows through government, multilateral, and donor channels — limiting private sector agility. Innovative PPP models and results-based financing mechanisms are emerging.

Infrastructure & Grid

Grid penetration in rural Ethiopia is below 40%. Frequent blackouts in grid-connected zones further reinforce the need for distributed solar solutions. Off-grid and hybrid systems offer practical entry points for SMEs and communities.

Human Capital

While Ethiopia has a strong academic base, vocational training in solar engineering and installation is still catching up. Partnerships with NGOs and international training bodies will be key for scaling workforce capacity.

Market Maturity

The market is still in an early phase. Most solar activity revolves around NGO-led initiatives and pilot projects. Local solar companies are emerging but face supply chain and regulatory hurdles. Distribution and maintenance networks remain underdeveloped.

GTM Feasibility

Mobile penetration is growing fast, and digital payment solutions are spreading, enabling models like PAYGO in certain regions. However, low purchasing power and logistical challenges require creative, partnership-based go-to-market strategies.

ESG / Impact

Ethiopia’s off-grid population exceeds 60 million — with immense potential in education, agriculture, and healthcare. Solar companies can create transformative impact, especially in refugee-hosting zones, rural schools, and agrarian communities.

Index Score

Top 3 Opportunities:

- Mini-Grids & Solar Home Systems for rural electrification

- B2B Rooftop Solar for urban SMEs and manufacturing hubs

- Agri-Solar Solutions to power irrigation, cold storage, and processing

Ethiopia

Diving into the Numbers

%

Approximately 35% of Ethiopia’s population—predominantly in rural areas—lacks access to electricity

As of 2023, Ethiopia’s estimated installed solar capacity stands at 21 megawatts

In 2024 alone, Ethiopia connected at least 100 rural communities to electricity through solar mini-grids, enhancing energy access in underserved areas